Budget 2021: live coverage and video review

Posted on 1st March 2021 at 23:01

Budget Day, Wednesday 3 March, 2021

Fuller Spurling’s own tax specialists, Amy and Philip, covered live the announcements of one of the most anticipated budgets for years.

Their coverage as the day unfolded is covered below.

Ahead of Budget Day, 3 March 2021

Amy and Philip will be following the day’s events live from the Fuller Spurling boardroom, whilst updating us with their observations and analysis live on Twitter and LinkedIn, using the following hashtags: #Budget2021, #FSBudget & #FSTax.

You can follow along (click here to go straight to our updates below), or just return here on Thursday for a video overview of the key points and changes.

This budget promises to be one of the most interesting in some time as we begin to learn how the Chancellor plans on facilitating the emergence of the economy from the Coronavirus pandemic.

When Rishi Sunak stands before the House on March 3rd, he will have to balance the fragile economy with rebuilding the public finances following the unprecedented and ongoing support of the past year.

And it seems almost everyone agrees that the need for further support is not over.

Which of these questions will he address on Wednesday’s budget?

Will he extend support packages, many of which are due to come to an end shortly?

Will he break the manifesto promise not to increase Income Tax, National Insurance and VAT rates?

Will Capital Gains Tax (CGT) increase?

Or will he change CGT reliefs such as Business Asset Disposal Relief or Investors’ Relief?

Will Inheritance Tax (IHT) be reformed?

Will he introduce a Wealth Tax?

Will he introduce a Sales Tax or a Windfall Tax on online retailers like Amazon who have benefited from the pandemic?

Will he extend Business Rates holidays?

Will he extend the 0% Stamp Duty Land Tax (SDLT) threshold?

Amy Robins

Philip Crowther-Green

Plus, return here from on Thursday 4 March for Fuller Spurling’s own video update, summarising the key points of what may be one of the most significant budgets for years.

Budget Day, 3 March 2021, live updates

13:13 Fuel duty

The fuel duty rate is frozen for the eleventh consecutive year and, according to the Government, has cumulatively saved the average car driver £1,600 compared to the pre-2010 escalator.

13:12 ‘Super deduction’

Super deduction of 130% for business investment.

When companies invest funds they may have a super deduction of 130% of the funds invested.

This will hopefully lead to companies spending excess cash on new materials for example, to move funds back into the economy.

13:10 Freeports

13:10 Corporation tax

In April 2023 the rate of corporate tax on profits will rise to 25%, but it was noted that this is still lower than some other jurisdictions such as the US. However this is a significant rise from the current 19%.

The small profits rate will be retained at 19%. Small businesses will therefore be unaffected. Only 10% of companies are intended to pay the full 25%

A taper of £50,000 will also be introduced for some companies depending on profit rates.

Added complexity, Philip suggests via Twitter

13:07 Frozen…

Pension lifetime allowance, VAT threshold, IHT nil rate band and CGT exemption all frozen

13:05 Help for hospitality sector

5% VAT rate confirmed for the hospitality sector for six months, to be followed by a 12% interim rate from October.

13:04 Income tax, NIC, VAT

Chancellor confirms that there will be no immediate rises in Income Tax, VAT or NIC.

But, personal allowances and tax bands are frozen; they will be increased next year to £12,570 but this will remain until April 2026.

The higher rate threshold will be £50,270 next April but this will be frozen for the same period.

This will freeze take home pay to its current level (net after tax).

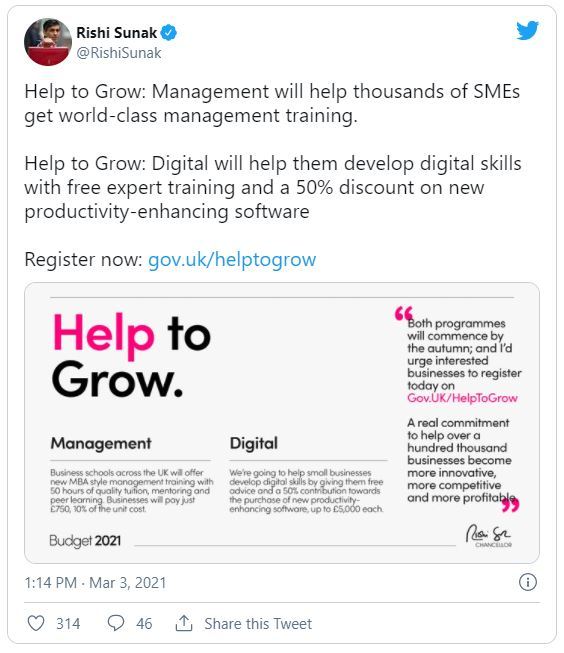

13:00 ‘Help to grow’

12:57 £407 billion

The chancellor states that £407bn has been spent on Coronavirus support.

12:54 Stamp Duty Land Tax

The SDLT cut has been extended to 30 June, with a phased reintroduction of normal rates to follow.

12:51 Business rates holiday

The business rates holiday will be extended to the end of June, with discounts for the remainder of 2021-22.

12:47 Self-employed grants extended

These grants to be extended for a further six months, taking them beyond the end of the national lockdown.

From April, the minimum living wage will rise to £8.91. The government is focusing on keeping those in work where possible.

£3,000 allowances for businesses who hire apprentices has also been announced, greatly increasing the funding available in this area.

12:45 Furlough extension confirmed

Furlough to be extended until the end of September with no changes. 80% of salary to be paid.

Businesses are asked to contribute toward wages: 10% from July and 20% from August.

12:15 Contactless payment limit

Consumer money champion from MoneySavingExpert.com, Martin Lewis writes that the chancellor will more than double the legal limit for contactless card payments, increasing it to £100.

12:00 Amy’s pre-budget comment

“I hope that there is a focus on a growth based recovery strategy with a longer term plan. Stimulating the economy should be the focus prior to any sharp tax increases for individuals or sole traders”

09:03 Beer duty to be frozen

“Beer duty is expected to be frozen to give pubs a flying start when lockdown is lifted”, writes The Sun.

08:43 Corporation tax to rise?

The Telegraph speculates that the rate of corporation tax could rise from the current 19%, possibly to as much as 23% or even 25%, adding this “would still be likely to be the lowest rate in the G7”.

08:00 Furlough extension & wider self-employed grant access

The Chancellor is to extend the furlough scheme until the end of September in today’s budget, writes the BBC.

It’s protected more than 11 million jobs since it started last March, but was due to close at the end of April.

And around 600,000 more self-employed people should become eligible for government help as access to grants is widened.

Questions or queries?

Please do let us know if you have any questions or if you need any further help understanding the guidance – please call us on 01932 564098 or message us here.

Information correct at time of publication

This note is written for the general interest of our clients and is not a substitute for consulting the relevant legislation or for taking professional advice.

Tagged as: Capital Gains Tax, Coronavirus, HMRC, Inheritance Tax, PAYE, Property, SDLT, Self Assessment, Stamp Duty, Tax, VAT

Share this post: