Whether you're looking for advice, an answer - or a new accountant - we're pleased you're here

Residence and domicile specialist tax advice

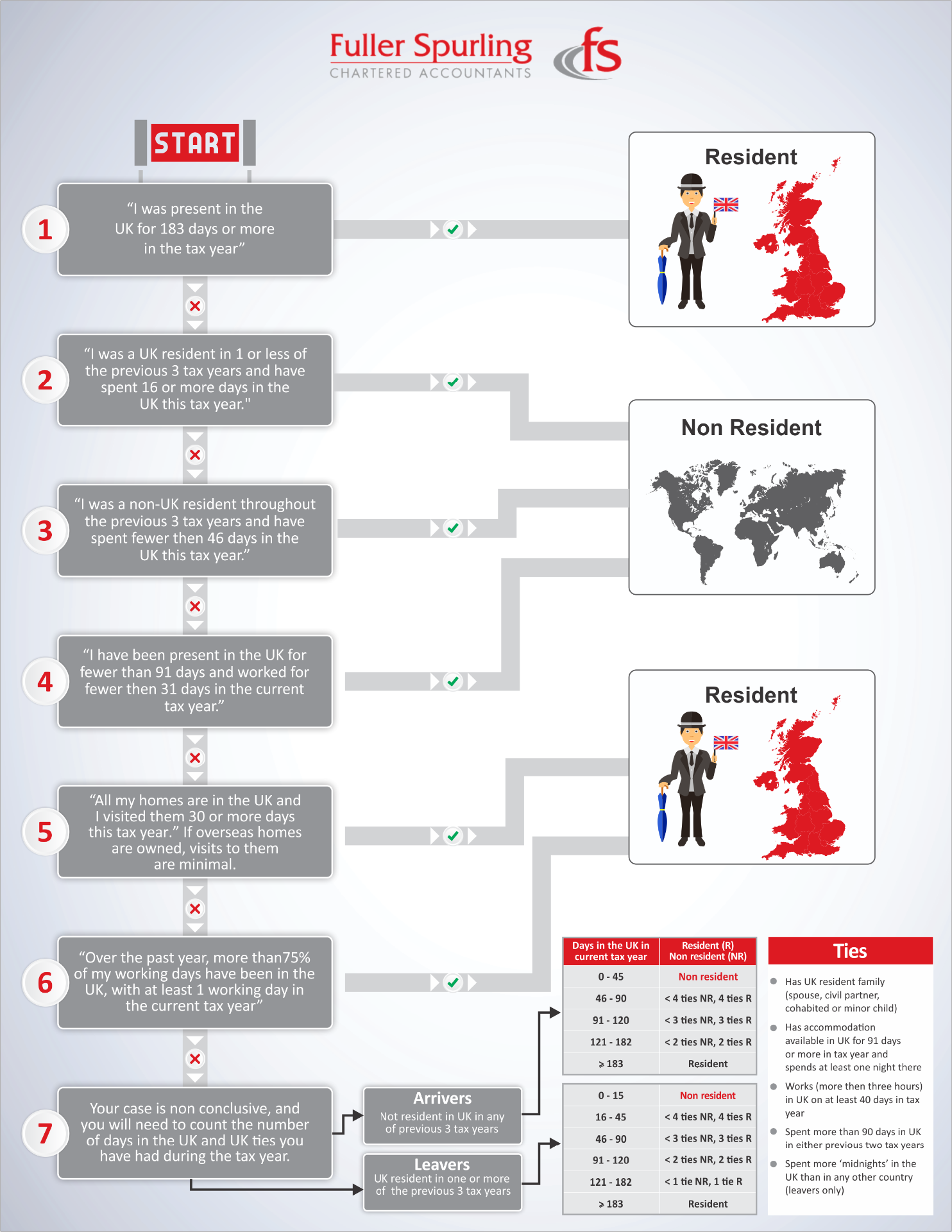

The UK has the “statutory residence test” in place to determine the tax residence status for individuals and this determines what is taxable and reportable to HMRC for each tax year.

If you are a UK tax resident you will need to prepare a tax return to report your worldwide income and pay tax on this. If your permanent home is outside of the UK, you were not born in the UK and depending on the amount of time you have spent here, you may be classed as a non-domiciled individual.

If you are a non-domiciled individual, you can elect to pay tax on your worldwide income or the remittance basis of taxation where you must declare your UK income and any foreign income or gains that you have brought into the country.

The statutory residence test has many different components and our qualified tax advisers are happy to discuss your individual circumstances with you.

To view the latest updates relating to residence and domicle advvice please click on the article below:

-

What happens to my tax position when I leave the UK?

What happens to my tax position when I leave the UK? , reportable income and the effects of Coronavirus on Residence Status is examined

-

Annual Tax on Enveloped Dwellings – ATED

ATED is an annual charge levied on UK dwellings which are owned by a non-natural person (a company).

-

Non-Domiciled Individuals – HMRC changes to guidance on remittance and loan collateral.

Previously HMRC had published guidance in relation to the remittance of foreign income and gains that have been retained offshore but used as loan collateral in relation to loans with a UK purpose. - we examine new guidance

-

Non-domiciled Individuals – the Remittance Basis explained

The Remittance Basis is an alternative tax treatment that is available to individuals who are resident but not domiciled in the UK.

-

Permanent Establishments “PE” – Non-resident companies & UK taxation

Many businesses have a place of origin in one territory but operate in other territories which can include an international presence from an employee or director perspective.

-

Changes to Corporation Tax for Non-Residents

In recent years the UK government has significantly changes the tax landscape in relation to both residential and commercial property. These changes have included increasing the scope of CGT for non-residents

-

Residency Riddles

A common question that is often asked is ‘what is the difference between residency and domicile?’ This is an area of tax law that is constantly evolving in the UK and an understanding of these two separate concepts is key for any taxpayers for whom it is relevant.

Are you deemed to be resident or non resident?

Please click the graphic to enlarge